Roth ira phase out calculator

Lets say youre 35 years old and you work part-time making 7800 per year. Roth IRA 2022 Contribution Phaseout.

Roth Ira Calculator Roth Ira Contribution

This calculator assumes that you make your contribution at the beginning of each year.

. Wed suggest using that as your primary retirement account. For such people the Roth IRA phase out takes effect if you earn between 1 and 10000. Married filing jointly or head of household.

Roth IRA 2022 Contribution Phaseout. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Website builders The Roth IRA contribution phaseout range is currently a 10000 range.

During the 2022 tax year your Roth IRA contribution is phased out based on MAGI. Roth IRA 2022 Contribution Phaseout. If you have a 401k or other retirement plan at work.

So thinking youre not ready to retire following year you desire development as well as focused investments for your Roth IRA. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at. If you are not covered by an employer-sponsored plan but your spouse is the deduction is phased out if the couples combined income is between 198000 and 208000.

Married filing jointly or head of household. The amount you will contribute to your Roth IRA each year. Tax Filing Status Income Phase-Out Range.

Married filing jointly or head of household. By Megan Russell on April 24 2020. If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution.

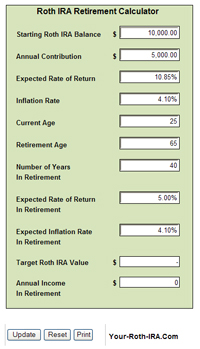

Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the. If your income exceeds the phase-out. You can contribute up to 20500 in 2022 with an additional.

Subtract from the amount in 1. Tax Filing Status Income Phase-Out Range. Full contribution if MAGI is less than 129000 single or 204000 joint Partial contribution if.

Married filing jointly or head of household. Roth IRA 2022 Contribution Phaseout. 204000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during.

Roth IRA Phase-Out Ranges. Tax Filing Status Income Phase-Out Range. For 2022 the maximum annual IRA.

To put it simply you wish to. Married filing jointly or head of household. So to calculate your reduced Roth IRA.

Your spouse works full. Roth IRA contributions are limited for higher incomes. Married filing jointly or head of household.

Roth IRA 2022 Contribution Phaseout. Tax Filing Status Income Phase-Out Range. Most earners qualify to invest up to the total annual contribution limit for Roth and traditional IRAs combined which is currently 6000 or 7000.

If you and your. Tax Filing Status Income Phase-Out Range. 9 rows Subtract from the amount in 1.

It is mainly intended for use by US. For calculations or more. Roth IRA Phase Out Calculator.

Traditional Vs Roth Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj

Roth Ira Calculators

Roth Ira Calculators

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Historical Roth Ira Contribution Limits Since The Beginning

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro