Calculate interest payment on heloc

This free online calculator will calculate the monthly interest-only HELOC payment given your current balance plus calculate the principal and interest payment that will take effect once the draw period expires. When you get an interest-only mortgage youll just pay the interest at a fixed rate for a fixed amount of time giving you a lower payment than a more traditional mortgage on the same loan amount.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

When youre buying a home mortgage lenders dont look just at your income assets and the down payment you have.

. This is the annual interest rate youll pay on the loan. Up to 95 LTV with a HELOC Combo Calculate your available funds. They look at all of your liabilities and obligations as well including auto loans credit card debt child support potential property taxes and.

This is known as the periodic interest rate or daily interest rate. Fixed-Rate Loan Option at account opening. To calculate credit card interest divide your interest rate or APR by 365 for each day of the year.

The institution that provides the financing. The interest may not be tax-deductible for example using a HELOC to pay for medical expenses. The result may also show the total amount of payments and total interest to be paid over the life of the loan.

The total is approximately 0018 or 000018 which is your daily interest rate. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment for a. HELOCs offer greater flexibility like the ability to pay interest-only for a 5 to 10 year draw window and then switch to a regular amortizing or balloon payment.

If you would like to calculate the size of the home equity line of credit you might qualify for please visit the HELOC Calculator. Prime Rates are set by the lenders and can differ from institution to insitution. So if a lender increases its prime rate then your HELOC interest payment increases.

However HELOCs still typically come with lower interest rates than other debt consolidation vehicles. Home equity loan rates are between 35 and 925 on average. A lower monthly payment so you can use that extra cash to get to a better place.

Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month. This means unlike the fixed payments in a fixed-rate mortgage a HELOCs rate is variable. For example if you have an APR of 65 you will create this equation.

15000 minimum loan amount required. For a HELOC the interest rate is typically a lenders prime rate 05. Input the annual interest rate you are charged on your HELOC.

Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest. HELOC transactions are subject to a 1 origination fee. The interest-only repayment option is an attractive feature of a HELOC.

For example on a 50000 HELOC with a 5 interest rate the payment during the draw period is 208. Calculate Your HELOC in Six Easy Steps. The calculator returns your estimated monthly payment including principal and interest.

Paying this interest will also likely be cheaper than incurring capital gains taxes that come from selling other investments especially if you. Pay off more high-interest debt. You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate.

Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance. The amount youve borrowed. When you have a HELOC you may be charged a small nominal annual fee - say 50 to 100 - to keep the line open but you do not accrue interest until you draw on the line.

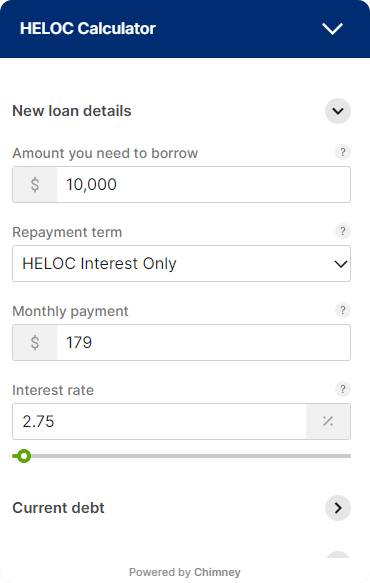

Therefore this is a significant increase and can be a problem for you especially if you have other debt payments or a high debt-to-income DTI. This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance. Borrower is responsible for paying.

Common car payment terms to know. Whereas during the repayment period the monthly payment can jump to 330 if it is over 20 years. The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount.

How to calculate HELOC payments. As you shop for a car and anticipate your loan costs the following are some helpful car payment terms to know. Input your remaining HELOC balance.

Enter your loans interest rate. Actual payments may vary. If your lender has told you that your fixed monthly payment is 43033 you.

Heloc Calculator

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Calculator Free Home Equity Loan Calculator For Excel

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Looking For A Heloc Calculator

Home Equity Loan Calculator Mls Mortgage

Home Equity Loan Calculator By Creditunionsonline Com Calculate Home Equity Loan Payments

Home Equity Loans Selco

Free Interest Only Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Loan Calculator Mls Mortgage

Mortgage Payoff Calculator With Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Calculator Free Home Equity Loan Calculator For Excel